We had recommended that investors buy the stock of Tata Group-owned Indian Hotels Co Ltd (IHCL) over two years ago in May 2023 at ₹372/share. Our view was based on asset-light growth, margin gains and tourism tailwinds. Since then, the top hospitality stock has more than doubled and outperformed the overall market’s 32 per cent rise. At CMP of ₹778, IHCL valuations of 46 times FY27 estimated earnings leave limited headroom for another swift doubling.

However, given its leading industry position and consensus estimates of 10 per cent earnings growth in FY26 and 18 per cent in FY27, the stock can remain a core holding for investors seeking hospitality exposure. Hence, existing investors can continue to hold the stock even after the solid gains over the last two years. New investors may wait for better entry points.

Strong momentum

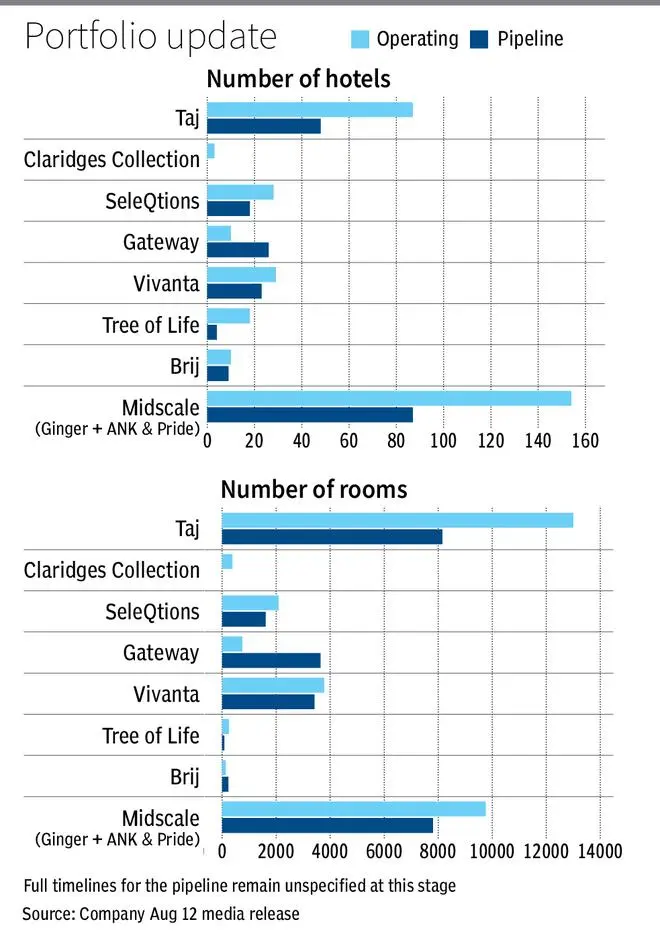

With the Indian hospitality industry well poised to continue its growth momentum, IHCL has, over the last 13 quarters, reinforced its position as market leader. Its network has more than 30,000 rooms, with around 50 per cent on managed contracts.

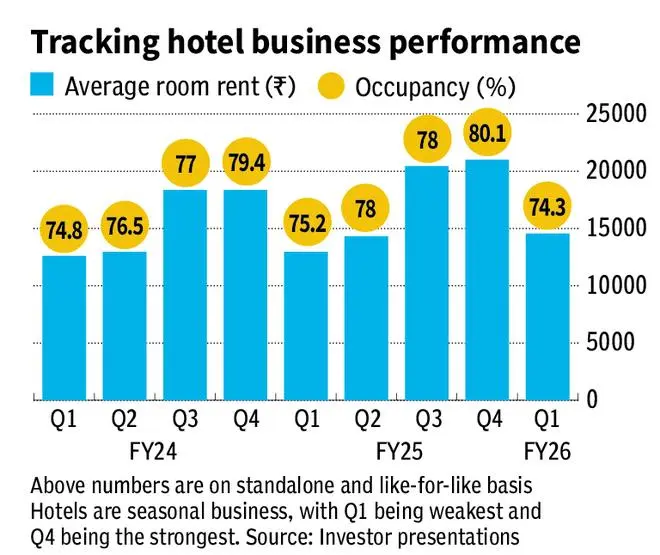

In Q1FY26, as the industry grappled with geopolitical factors (Pahalgam, Israel-Iran), early monsoon and evolving travel patterns, IHCL outpaced peers with 32 per cent revenue growth and 29 per cent EBITDA rise. This helped lift PAT by 19 per cent. Average room rate (ARR, like-for-like) grew 12 per cent in Q1FY26, while occupancy dipped 90 bps to 74.3 per cent (see chart below).

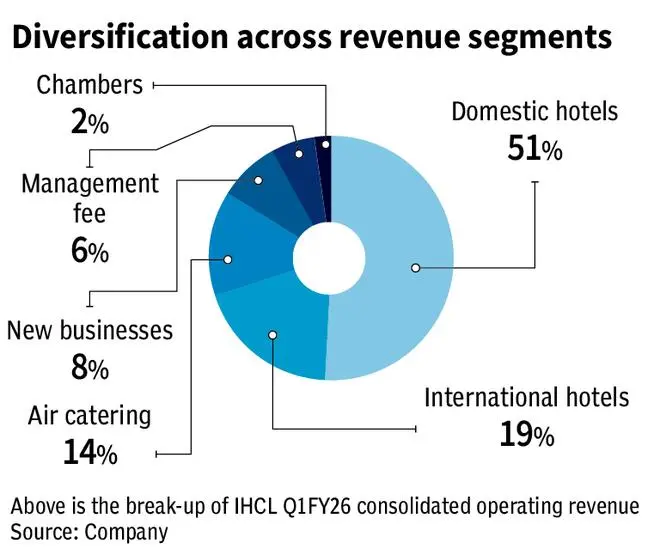

IHCL’s new businesses vertical comprising Ginger, Qmin, amã Stays & Trails and now also Tree of Life continued to showcase strong growth of 27 per cent year on year. Its airline catering business, TajSATS reported a robust 22 per cent growth.

The company’s capital-light growth helped boost management fees by 17 per cent, and this helped higher flow-throughs to the EBITDA (30.3 per cent margin).

Industry trends also favour IHCL. Consulting firm Hotelivate projects demand to grow at a CAGR of 9.7 per cent through FY28, while supply will lag. This imbalance is likely to keep IHCL’s margins resilient.

Notably, IHCL’s diversification helps maintain growth across cycles (see chart below), and continued momentum adds to FY26-27 visibility.

Growth visibility

Taj luxury properties account for 43 per cent of IHCL rooms. Mid-scale (Ginger + ANK & Pride) forms 32 per cent. Upscale-lifestyle (Vivanta) and collections segment (SeleQtions) form the other major portfolio contributors. With the planned room pipeline initiatives underway (to over 55,000 rooms), IHCL is going to be an equally key player in the mid-scale segment, which is one of the country’s fastest-growing hotel segments (see chart below).

While room rates in luxury and upper upscale segments are on their way towards peaks, mid-market hotel rooms offer a big growth runway and remain a strong area, going forward. The GST Council has reduced the tax on rooms priced up to ₹7,500 per night to 5 per cent (from 12 per cent earlier). This should benefit IHCL’s Ginger.

As an earnings machine, IHCL remains a steady one. According to Bloomberg consensus estimates, IHCL consolidated topline will grow 18.5 per cent in FY26, followed by 13 per cent rise in FY27. These rates are on a higher base, and hence should not be seen as a sharp slowdown versus the last two years (16.5 per cent FY24 and 23 per cent in FY25). Annual consolidated EBITDA margins are expected to come in at 35 per cent, stronger than 31-33 per cent in the previous two years.

IHCL’s asset-light model ensures scalability without straining the balance sheet (net cash ₹2,800 crore). There is no immediate need to raise debt. About ₹1,200 crore has been earmarked for capex for FY26 and is focussed on ongoing projects, upgrades and digital initiatives.

Structural demand growth via tourism, corporate, weddings, events are expected to hold its business in good stead. International inbound recovery, which hasn’t played out for the industry, remains a key swing factor for the future.

Till now, IHCL’s growth has been steady, but it is not accelerating at a stronger pace. Bottom-line growth expectations of 10 per cent in FY26 and 18 per cent in FY27 are a case in point. They are steady, though hardly eye-catching for a sector leader.

Valuations

Earnings growth, while healthy, is unlikely to excite investors chasing high growth. This limits scope for further re-rating and is the main reason for our moderated stance. This is not to say that IHCL’s fundamentals have weakened. Momentum for FY26 could well turn out to be robust in the second half, as events such as the India AI Summit, Wings India 2026, ICC Women’s World Cup and high-profile diplomatic visits by Heads of State provide a fillip. Five-star marriage/receptions business is expected to be brisk in November-March period, but such gains will not be unique to IHCL.

In May 2023 when we gave a ‘buy’ on IHCL, the stock was trading at a forward price to earnings multiple of 36 times FY25 estimates. Its current valuation of 46 times FY27 estimated earnings already captures much of the upside, with the stock up 108 per cent. On a trailing price to earnings basis too, the stock trades at 58 times, a mere 6 per cent discount to five-year average of 61.7 times. This suggests that the easy gains are largely behind.

Thus, existing investors can stay invested given that IHCL remains one of the best ways to play the Indian hospitality sector, but risk-reward at current levels does not justify fresh buys. We will revisit our stance after Q4 and FY26 results if earnings surprise on the upside.

Risks to the call are softening in room rates and occupancy, poor business in seasonally-stronger second half of the year, new supply catching up with demand beyond FY27, and occurrence of any negative macro event that hits tourism sector.

Published on September 13, 2025

Leave A Comment