Ever since the GST 2.0 reforms were announced in the Prime Minister’s 79th Independence Day address, Indian equity markets have witnessed a notable rise in consumer-sensitive sectors. Market sentiment turned positive on expectations of higher consumption, improved margins and a simpler taxation regime.

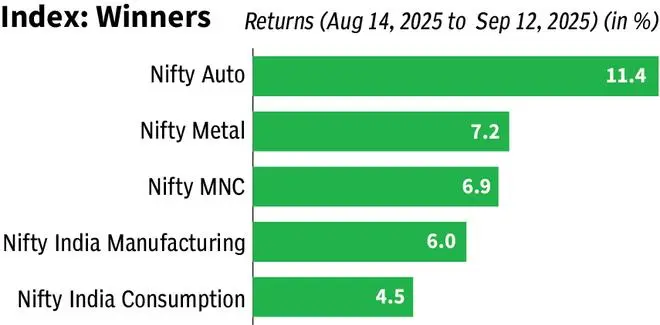

Between August 14 and September 12, sectors such as autos (11.4 per cent), MNCs (7 per cent) and consumption (4.5 per cent) gained and outperformed the broader indices, with the Nifty 50 rising 2 per cent during the period. Two-wheeler and small car manufacturers advanced on hopes of price cuts in automobiles, while FMCG MNCs gained on expectations that daily-use items would become cheaper, boosting volumes.

The revised GST regime simplifies the slab structure from four to three — 5 per cent, 18 per cent and 40 per cent (the highest rate applying to luxury and sin goods) — with implementation scheduled for September 22. Several goods, previously taxed at 12 per cent or 28 per cent, have been moved into lower brackets.

Here are the winners and laggards among stocks and sectors over the said period.

Autos, EVs and FMCG led the market rally with double-digit and high single-digit gains, reflecting strong consumption and mobility trends.

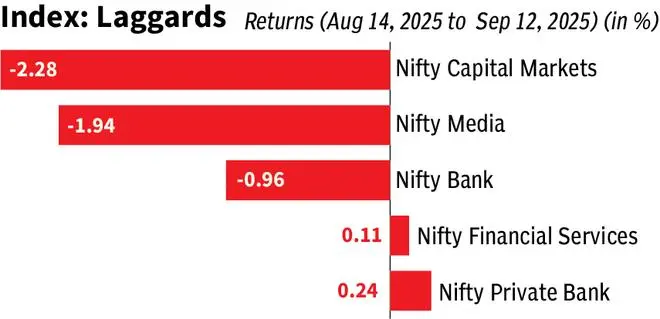

Capital markets, media and banking indices dragged the markets with negative to flat returns.

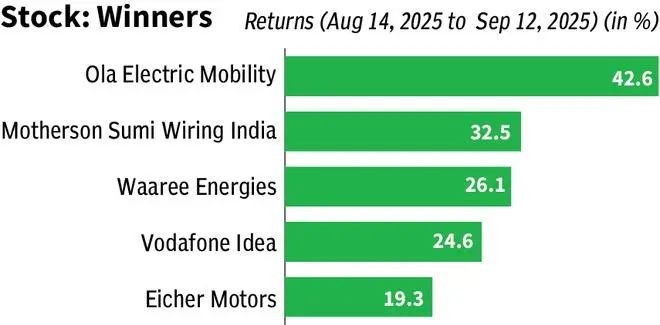

Ola Electric, Motherson Sumi and Waaree Energies topped the charts with stellar gains, reflecting strong momentum in EV and renewables. Autos, consumer plays and financials like Maruti, Britannia and Bajaj Finance also delivered double-digit returns, boosting market sentiment.

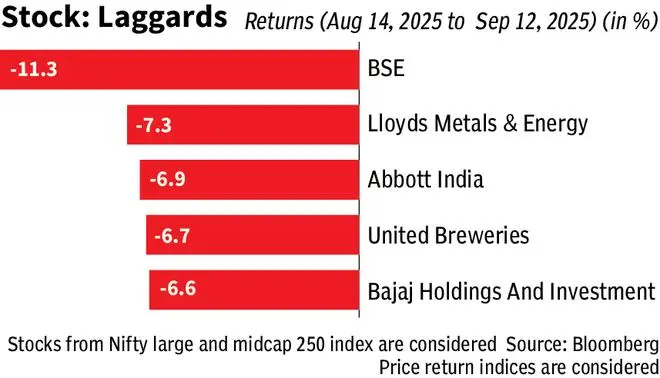

Broader weakness was visible in capital market, beverages, cement, ratings and small finance banking stocks.

Published on September 13, 2025

Leave A Comment