Systematic Investment Plans (SIPs) have long served as a reliable method for investors to access equity markets through mutual funds. Historically, SIPs in well-managed equity-oriented schemes have generated strong long-term returns. However, recent data indicates a shift in investor behaviour. According to AMFI, in March alone, 51.55 lakh SIPs were discontinued or completed, while only 40.19 lakh new SIPs were registered during the same period. This trend suggests a growing hesitation among investors.

A key reason behind this reversal is the recent market volatility, which has particularly impacted younger investors. Many of them began SIPs during the bullish period following 2020, assuming such high returns would continue. Confronted with their first major market correction, they responded emotionally, influenced by recency bias and a lack of exposure to full market cycles.

Do not stop your SIP

Moreover, limited financial literacy contributes to misconceptions about investing. Many fail to grasp that short-term fluctuations are a natural part of the market and that enduring them is essential for long-term wealth creation. Rather than reacting to temporary dips, investors should stay on the course. Continuing SIP investments through market ups and downs is often the most effective strategy to build wealth over time.

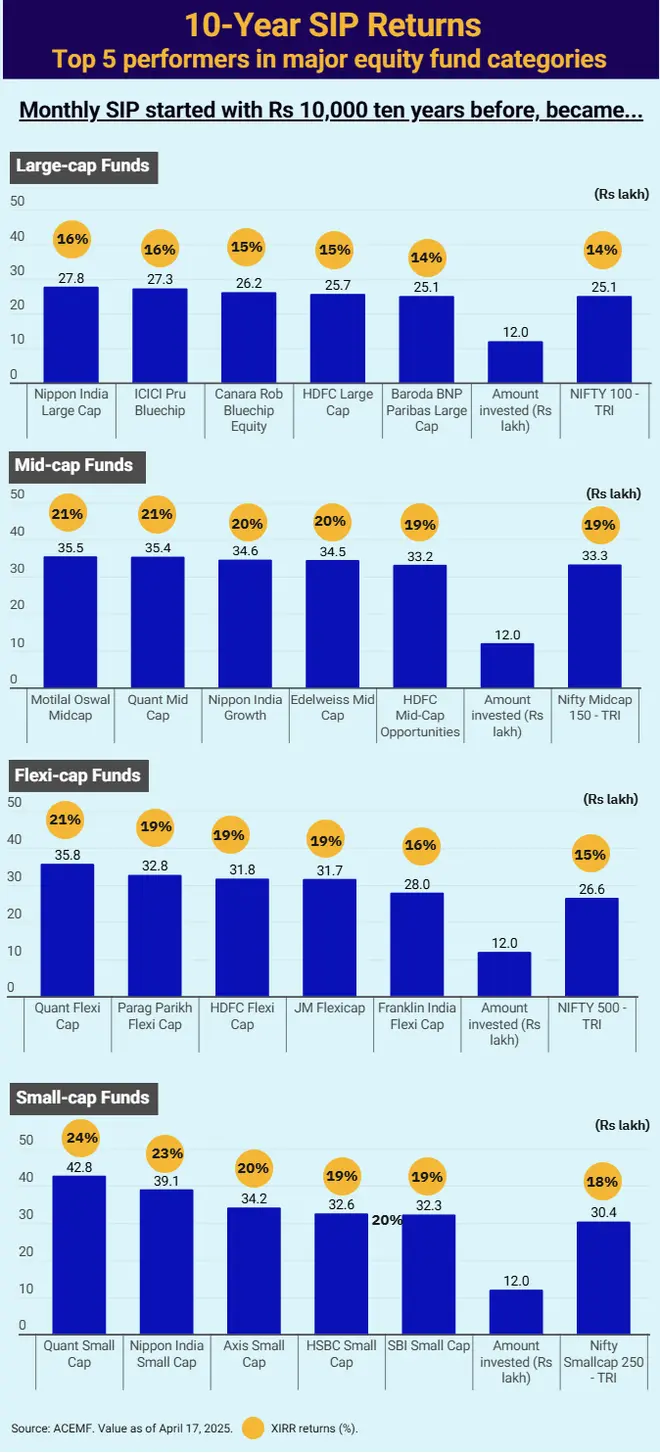

The accompanying table illustrates the advantages of staying invested in SIPs without being concerned by short-term market fluctuations.

Published on April 21, 2025

Leave A Comment