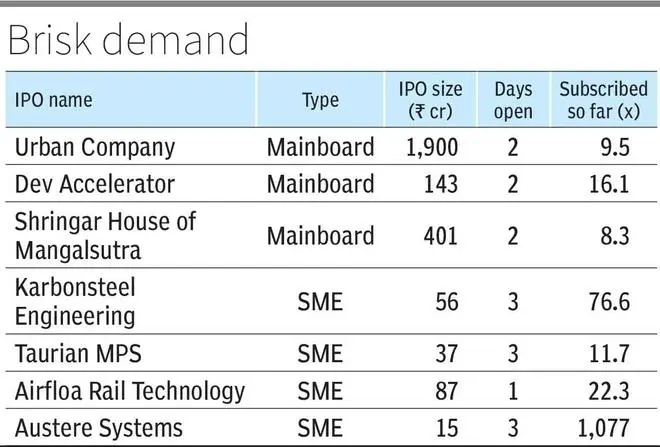

Initial public offerings (IPOs) are seeing brisk demand, even amidst the ongoing market turmoil. Urban Company, the app-based beauty and home services platform, has already been subscribed over 9 times, Dev Accelerator 16 times and Shringar House of Mangalsutra about 8 times on their second day of bidding.

SME IPOs are drawing investors in droves, with subscription multiples running into the dozens and even hundreds. Karbonsteel Engineering, Airfloa Rail Technology and Taurian MPS have attracted robust investor interest, while Austere Systems has seen subscriptions soar into four digits, at 1,077 times.

Among these issues, Karbonsteel and Taurian were subscribed nearly 77 and 12 times, respectively. Meanwhile, Airfloa Rail Technology exceeded 22 times on its first day, led largely by retail investors.

Volatile markets

This surge comes even as global headwinds, weak foreign flows, geopolitical tensions and currency volatility have weighed on investor sentiment in most equity markets. Regulatory caution around micro companies and stricter rules to curb speculative excess have also not deterred market enthusiasm.

“IPOs are seeing strong oversubscription despite ongoing market turbulence — in some cases as high as 10 to 15 times. This surge is driven by recent IPOs delivering solid listing gains, creating a fear of missing out among retail investors,” said Ratiraj Tibrewal, Director at Choice Capital. “Additionally, abundant domestic liquidity is encouraging investors to move from volatile secondary markets to promising primary market opportunities.”

Diverse appetite

The high demand is not just company-specific but is led largely by individual investors seeking opportunities in new growth stories and sectors. For instance, despite Urban Company’s high valuation, its IPO has already been subscribed nine times — showing strong investor appetite for scalable, tech-enabled consumer businesses, Tibrewal said.

Mahavir Lunawat, Managing Director at Pantomath Capital Advisors, said investors are not just chasing a theme but backing multiple growth narratives: “From tech-driven service platforms like Urban Company, to innovation enablers such as Dev Accelerator, and EPC companies like Vikran Engineering. While the oversubscription numbers clearly indicate confidence in India’s entrepreneurial ecosystem, the eventual performance of these companies will hinge on their ability to scale profitably, demonstrate governance, and deliver on long-term promises.”

A fear of missing out and increased accessibility have boosted retail participation even in volatile conditions, while attractive valuations and growth narratives, including digital adoption and rising incomes, have increased optimism for technology and services firms, said Ajay Garg, CEO at SMC Global Securities.

However, analysts caution that while oversubscription is often taken as a signal of market confidence, it does not always guarantee strong performance post-listing. Several highly subscribed IPOs in the past have stumbled after debut, showing that investor enthusiasm can sometimes outpace fundamentals.

Published on September 11, 2025

Leave A Comment