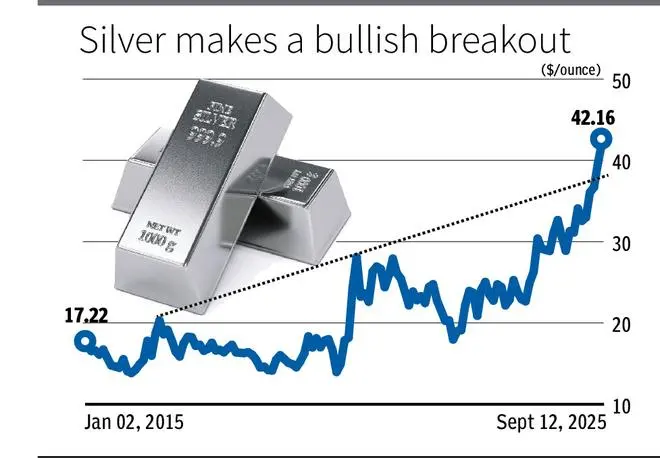

Silver prices, surging 24 per cent in the last three months, have been hitting the headlines. Indeed, silver has clearly outperformed gold during this period. The yellow metal has risen 10 per cent in the last three months. For the first eight-month period (January to August) of 2025, the 37 per cent surge in price has been the best for silver since 2020. At the current market price of $42 per ounce, silver is at its highest over the last 14 years — up over 45 per cent (year-to-date).

While the sharp rise in silver prices might have surprised many in the market, not so for regular readers of bl.portfolio. In the bl.portfolio edition dated May 1, 2025, we had forecast the silver price going up to $42-43/ounce. The price was $33 per ounce at that time. This rise has almost happened.

Driving factors

According to a recent Silver Institute release, strong inflows into the silver-backed Exchange Traded Products (ETPs), huge build-up of long positions by traders, strong retail demand, and elevated gold/silver ratio are the major drivers of silver prices. The release says that the net inflow of 95 million ounce in the first half of 2025 has already surpassed the total inflows of 2024.

Data from the Commodity Futures Trading Commission (CFTC) show that the net long positions (non-commercial) in silver in the Commodity Exchange Inc (COMEX) have surged 48 per cent so far this year. The net long positions have increased from 37,889 contracts by the end of 2024 to 55,923 contracts as of September 2, 2025.

The gold/silver ratio surged above 100 for the first time since June 2020 by the end of March this year. It peaked at 107 in mid-April leaving silver to look more undervalued. A weak dollar and the recent fall in the US Treasury yields have also been supporting factors for the recent surge in silver prices. Dollar and commodity prices are inversely correlated.

A weak dollar makes it cheap for buyers with other currencies. The dollar index fell from a high around 102 in mid-May to mark a low of 96.35 in July. It is currently hovering around 97.50. The US 10-Year Treasury yield has declined sharply from around 4.6 per cent in mid-May to about 4 per cent now.

Deficit Year

On the demand/supply front, silver is likely to end with a deficit for the fifth consecutive year. Metal Focus’ World Silver Survey 2025, produced for the Silver Institute, forecasts a deficit of 3,660 tonnes for 2025. A projection for 7 per cent rise in coin and bars demand to 6,359 tonnes this year is expected to be the major factor in leaving the market in deficit.

What next?

The recent rise above $40/ounce and the subsequent break above $42 last week is significant. While this sustains, the upside is open to target $50-51 in the coming months. The gold/silver ratio, currently at 86, has room for falling to 78. This indicates that silver can continue to rise and outperform gold.

Be Cautious

However, more caution is needed at this point of time rather than being extremely bullish on the white metal. The reason is that the silver price rally seems to be getting stretched. There could be an intermediate correction in price before it heads up towards $50. Secondly, inflation in the US has been ticking higher over the last few months.

US Inflation effect

Data released last week showed that the US Headline Consumer Price Index (CPI) rose by 2.94 per cent (year-on-year) in August. This leaves the scenario uncertain about how much the US Federal Reserve can cut rates from current levels. Further rise in inflation on the back of high tariffs can push the US Treasury yields higher. That, in turn, could result in a strong dollar and drag silver prices lower.

Thirdly, if there is a global slowdown on the back of high tariffs in the US, it may have an impact on the industrial demand for silver.

Lastly, the volatility is high in silver. History suggests that the fall in silver price after a strong rally has been sharp and swift. So, even if the price goes up to $50, a reversal thereafter could be very fast. So, traders having positions in silver may have to look for booking profits as the price goes up to $50.

Published on September 13, 2025

Leave A Comment