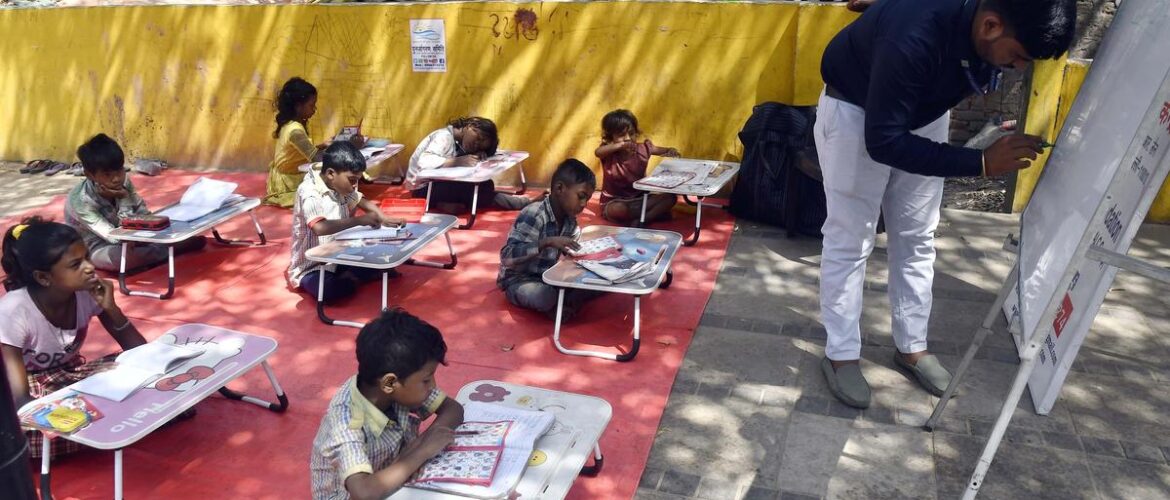

In the quiet village of Nandgaon in Raigad, Maharashtra, Laxman Waghmare’s life has been transformed. Once dependent solely on farming and daily wages, he now earns an additional ₹80,000 annually after learning masonry — a gift made possible through the generosity of donors, giving him the chance to provide his family with a better life and a hopeful future. India is home to over 300 million young people, two-thirds of whom live in rural areas, often disconnected from opportunities that could change their lives. Imagine if more young men and women could receive skills as gifts. Together, we could unlock not just economic growth, but also hope, dignity, and new possibilities for millions.

While stories like Laxman’s inspire hope, they raise a larger question: how do we ensure that acts of giving are scaled, trusted, and truly transformative? This is the very premise of the Indian Social Stock Exchange (SSE). A platform that blends the structure of financial markets with a mission to advance social good at scale – benefitting many deserving people like Laxman.

When you hear the term “stock exchange,” you may think of investors buying shares in companies and earning profits as those companies grow. The Social Stock Exchange borrows this idea but with a different purpose: instead of buying shares, you contribute to a non-profit’s project. And instead of financial dividends, you receive social returns — the impact created by supporting causes like education, clean water, climate action, and so much more.

The SSE runs parallel to capital markets in structure. Just like companies list on the NSE or the BSE to raise funds from the public, NGOs and non-profits can list their projects on the SSE to raise funds. And just as companies are bound by strict disclosure norms, NGOs on the SSE must report transparently on how funds are used and what social impact is achieved. The idea of the SSE was first mooted in the 2019-20 Union Budget to help social organisations raise funds with greater transparency. SEBI brought this idea to life in 2022, creating a platform where purpose-driven projects can connect with people who want to make a difference.

Tapping India’s investor base

Social sector funding has grown steadily to ₹25 lakh crore in FY24 and is projected to reach ₹45 lakh crore by FY29. The demat accounts in India have crossed 200 million (led by investors under the age of 30), according to data from depositories CDSL and NSDL. This growing base presents a huge opportunity for the SSE. The minimum investment, which began at ₹2 lakh, has since been reduced to ₹10,000 and now to ₹1,000, significantly lowering the entry barrier for individual donors. The SSE opens the door for everyday citizens to be part of meaningful change.

Levelling the playing field

Most small NGOs simply do not have the bandwidth or budgets to run large fundraising campaigns, even though they are engaged in vital work at the grassroots level. This lack of visibility often keeps them from getting sustained donor support. Per a Kearney and Dasra study, a staggering 72 per cent of them face a funding deficit, raising concerns about their long-term sustainability. A mere 1 per cent operates with annual budgets over ₹50 crore. By offering smaller NGOs greater visibility and credibility, the SSE helps shift the focus of support towards measurable impact rather than fundraising capacity.

To be listed, NGOs must meet strict eligibility criteria and disclose financial statements, impact reports, and governance structures, much like corporates share quarterly earnings. This level of transparency transforms vague donations into accountable contributions, builds trust with donors, and gives smaller organisations a fair chance to compete with larger ones.

Drives national progress

Furthermore, by enabling features like one-click e-IPO donations and SEBI-mandated reporting, the SSE makes institutional costs such as administration and staff development transparent and easier to justify. This means NGOs can cover operational costs like salaries, training and system improvements rather than being limited to short-term programmes alone.

The SSE presents a unique opportunity for accelerated nation-building by enabling focused investment in social and environmental causes that drive development at scale. By aligning closely with India’s commitment to the United Nations’ Sustainable Development Goals, SSE can aid strategic funding channelled towards initiatives that directly contribute to these global targets. It can give NGOs the space to prioritise innovation and experimentation, which is often a luxury under tight budgets.

By July 2025, 145 NGOs had registered on the NSE-SSE, collectively raising over ₹43 crore through 14 projects. Success stories like Prashanthi Balamandira Trust’s ₹18 crore raise and Swades Foundation’s ₹10 crore demonstrate how small contributions from many donors can come together to drive large-scale social change.

With NSE’s reach of over 120 million unique investors, the SSE framework has the potential to mobilise an even wider base of social investors.

Ahuja is Head of Social Stock Exchange at NSE, and Wange is CEO and Board Member at Swades Foundation

Just like companies list on the NSE or the BSE to raise funds from the public, NGOs and non-profits can list their projects on the Social Stock Exchange to raise funds

Published on November 1, 2025

Leave A Comment